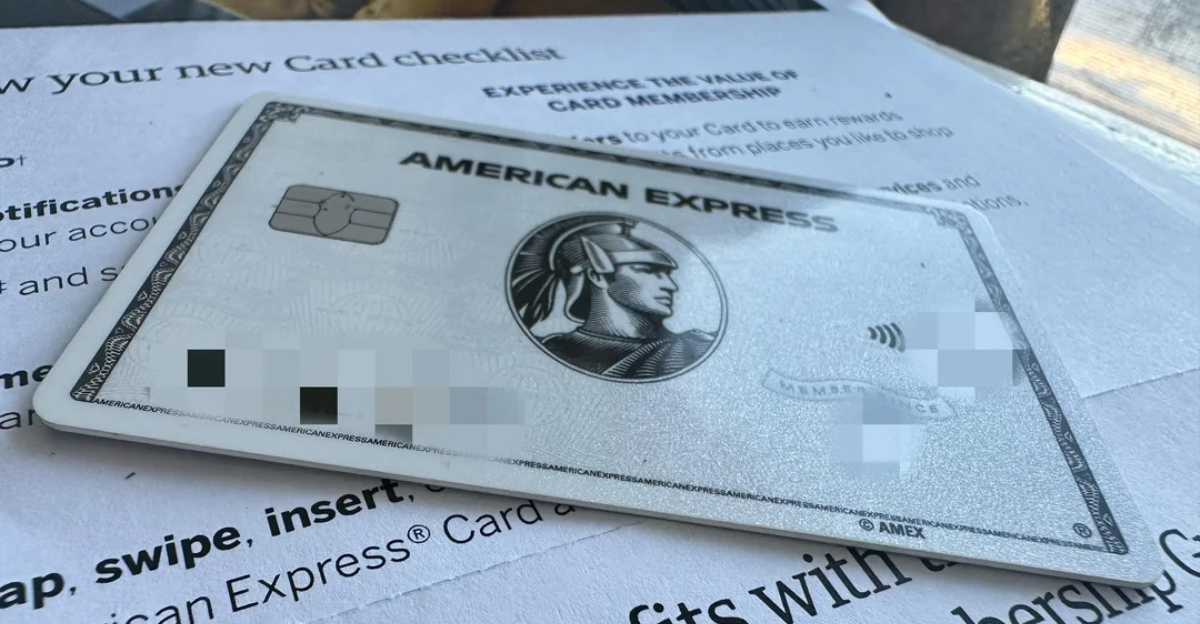

The American Express Platinum Card used to be the crown jewel of credit cards. Flash it at dinner, and you weren’t just paying…you were making a statement. But times have changed. The annual fee is creeping dangerously close to $1,000, and not everyone’s clapping. Especially Boomers, who once swore by it. Now? They’re starting to wonder if they’re being left behind in favor of yoga retreats, streaming perks, and digital status they didn’t ask for.

The Current Cost of Exclusivity

Holding an Amex Platinum card now means shelling out $695 a year, before adding any users. That fee supposedly unlocks elite perks: airport lounges, travel credits, Uber rides, and hotel upgrades. But unless you’re maxing out every benefit (and remembering to activate them), you might just be paying a premium for shinier plastic.

Who Are the Boomers? Understanding the Traditional Customer Base

Baby Boomers (1946 -1964) grew up on loyalty and luxury. They are the generation that once saw the Platinum Card as a reward for years of hard work. Frequent flyers. Big spenders. Retirees with taste. For decades, they were Amex’s backbone. But now the card is changing, and so are their needs.

The Rise of Millennials and Gen Z Cardholders

Younger folks are stepping in where Boomers are stepping back. Millennials and Gen Z are grabbing the Platinum Card not just for travel, but for the vibes. They want lounge selfies, streaming credits, and digital rewards. For them, the card is less about tradition and more about lifestyle. And Amex noticed.

Spending Patterns

Boomers swipe for travel, fine dining, maybe the occasional luxury hotel. They like big, reliable returns. Younger generations, though? They tap for DoorDash, festivals, boutique gyms, and whatever new app is trending. One side wants comfort and consistency. The other wants experiences and flexibility. Same card, wildly different definitions of value.

What’s Driving the Increase for the Upcoming $1,000+ Fee

Amex is piling on perks, and those extras come with a price. More lounge partnerships, more lifestyle credits, more curated experiences. All flashy stuff, but not free. With inflation, rising partner costs, and a push to stay premium, the fee hike feels less like greed and more like strategic spending math.

New Perks Tailored for Younger Consumers

Forget travel insurance and concierge services. Amex is handing out credits for streaming, food delivery, fitness apps, and even music festivals. It’s beginning to look like a whole rebrand aimed at digital natives who live online and want their card to feel like a passport to modern convenience.

What Boomers Value: Traditional Travel and Luxury Benefits

Boomers want airport lounge access without jumping through apps. They care about hotel upgrades, travel insurance, and speaking to an actual person when things go wrong. The Platinum Card once delivered all that with ease. No gimmicks. No hoops. Just clean, classic luxury that felt earned. That’s what made it timeless.

How the New Benefits Miss the Mark for Boomers

Boomers are not itching for Uber credits or discounted yoga memberships. They are not streaming all day or booking Airbnb on impulse. Many of the new perks feel like clutter. Extras they did not ask for and may never use. The card is shifting, and some Boomers are feeling sidelined.

Digital and Lifestyle Trends Influencing Amex’s Strategy

Amex is chasing where the culture’s headed. Mobile-first lifestyles, subscription perks, instant gratification. Today’s cardholders want everything managed through an app, tracked in real time, and tied to their digital identity. The company is following the money, straight into the hands of younger consumers who live more online than off.

How Other Premium Cards Are Responding

Chase Sapphire Reserve, Capital One Venture X, Citi Prestige, they all want a piece of the premium pie. They offer similar perks with lower fees and fewer hoops. Some even give points that feel easier to redeem. Amex may have prestige, but competitors are coming in strong with simpler rewards.

The Psychology of Pricing: Why $1,000 Matters

There is something about crossing the four-digit line that makes people pause. Seven hundred feels premium. One thousand feels absurd. Even if the math checks out, the emotion doesn’t. Boomers, especially, were raised on practicality. Paying a thousand just to carry a card? That feels more like a statement than value.

Impact on Brand Loyalty Among Older Customers

Boomers were once the Platinum Card’s biggest fans. Now, some feel pushed aside. The benefits they valued are fading, replaced by things they barely recognize. Loyalty only goes so far when a brand starts speaking a new language. Some are quietly canceling. Others are loudly asking what happened to their card.

The Role of Inflation and Economic Factors

Prices are up on just about everything these days. Eggs. Gas. Airfare. And now, even your credit card wants a raise. Amex claims it is inflation, partner costs, and premium upgrades. Maybe that’s true. But try telling that to a retiree on a fixed income who barely uses Uber Eats.

How American Express Is Marketing the New Platinum Card

Amex is not selling business trips and airport lounges anymore. Now it is rooftop parties, luxury pop ups, and whatever curated lifestyle the next app is pushing. The vibe? Young, flashy, always online. It is not subtle. The Platinum Card is chasing cool, and somewhere along the way, Boomers got left off the guest list.

Case Studies: Boomers Who Are Dropping the Card

Take Linda, 68, who used her Platinum for decades. After the third year of unused perks and rising fees, she canceled. Same with Mike, 72, said he felt like the card started speaking a language he did not understand. They are not alone. Quiet exits are happening, and Amex definitely notices.

The Future of Premium Credit Cards

Premium credit cards are not just about points anymore. They are turning into personality badges. One day it is early access to concerts, the next it is some digital perk you have to activate by Tuesday. Things are moving fast. And somewhere in all that flash, old-school loyalty might just get left behind.

Alternatives for Boomers Seeking Luxury Benefits

Thankfully, there are good alternatives for Boomers. Cards like Chase Sapphire Preferred and Capital One Venture offer Boomers all the perks they seek while keeping everything simple.

Expert Opinions

Experts believe that this shift is not an accident. They feel that Amex is looking for younger (digitally savvy) spenders. Financial advisors point out that plenty of older users are now paying for perks they do not even use. Some call it evolution, others call it exclusion. Either way, the card’s clearly changing its priorities.

Conclusion: Is the $1,000 Platinum Card Worth It?

For some, the Platinum Card still delivers if you live fast, spend big, and love curated extras. But for Boomers who value simplicity, tradition, and practical rewards, the glow is fading. A thousand dollars is a lot to ask. The question now is, who exactly is Amex trying to impress?